vermont sales tax rate 2021

Groceries and clothing are exempt from the Dover and Vermont state sales taxes. The Vermont sales tax rate is currently 6.

Vermont Sales Tax Rates By City County 2022

You can find your sales tax rates using the below table please use the search option for faster searching.

. 2022 Interest Rate Memo. These taxes are collected to provide essential state functions resources and programs to benefit both our taxpayers and Vermont at large. The Dover Sales Tax is collected by the merchant on all qualifying sales made within Dover.

Vermont sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Vermont tax forms are sourced from the Vermont income tax forms page and are updated on a yearly basis. Look up 2022 sales tax rates for Strafford Vermont and surrounding areas.

Vermont School District Codes. Ad Automate Standardize Taxability on Sales and Purchase Transactions. This is the total of state county and city sales tax rates.

The Vernon sales tax rate is. 31 rows The state sales tax rate in Vermont is 6000. RateSched-2021pdf 3251 KB File Format.

City Total Sales Tax Rate. 2021 ernt a ales Page 1 5. The Vermont sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the VT state sales tax.

PA-1 Special Power of Attorney. The minimum combined 2022 sales tax rate for Vernon Vermont is. Avalara provides supported pre-built integration.

Integrate Vertex seamlessly to the systems you already use. Did South Dakota v. Tax Rates and Charts Tuesday January 25 2022 - 1200.

Wayfair Inc affect Vermont. The County sales tax rate is 0. The minimum combined 2022 sales tax rate for Ludlow Vermont is 6.

Vermont School District Codes. I aale Ince s. 12 12 12 12.

Start filing your tax return now. This is the total of state county and city sales tax rates. 2021 VT Tax Tables.

Wayfair Inc affect Vermont. Vermont Sales Tax Rates 2021. Base Tax is of 3189.

Vermont State Sales Tax Rates. Department of Taxes. For Adjusted Gross Incomes IN-111 Line 1 exceeding 150000 Line 8 is the greater of.

Dover collects a 1 local sales tax. Find your Vermont combined state and local tax rate. The County sales tax rate is.

Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets. Tuesday January 25 2022 - 1200. Tax rates are provided by Avalara and updated monthly.

Filing Status is Married Filing Jointly. We have tried to include all the cities that come under Vermont sales tax. The 2018 United States Supreme Court decision in South Dakota v.

Look up 2022 sales tax rates for Kansas Vermont and surrounding areas. The maximum local tax rate allowed by Vermont law is 1. The Vermont sales tax rate is currently.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. The base state sales tax rate in Vermont is 6. 294 rows 2022 List of Vermont Local Sales Tax Rates.

A L B L S Married T filing filing - - hold. Department of Taxes. Here is a list of current state tax rates.

En r ernt a s. The Dover Vermont sales tax is 700 consisting of 600 Vermont state sales tax and 100 Dover local sales taxesThe local sales tax consists of a 100 city sales tax. Tax Year 2021 Personal Income Tax - VT Rate Schedules.

I aale Ince. Tax Rates and Charts Thu 12162021 -. 2021 Vermont Tax Tables.

IN-111 Vermont Income Tax Return. Exemptions to the Vermont sales tax will vary by state. N r lng stats s.

Taxvermontgov Page 42 2021 Vermont Tax Rate Schedules. Did South Dakota v. If you need access to a database of all Vermont local sales tax rates visit the sales tax data page.

Vermont has a statewide sales tax rate of 6 which has been in place since 1969. 5 5 5 5. The major types of local taxes collected in Vermont include income property and sales taxes.

Tax rates are provided by Avalara and updated monthly. 15 15 15 15. W-4VT Employees Withholding Allowance Certificate.

Lowest sales tax 6 Highest sales. 22 22 22 22. Click any locality for a full breakdown of local property taxes or visit our Vermont sales tax calculator to lookup local rates by zip code.

PA-1 Special Power of Attorney. 25 25 25 25. The Ludlow sales tax rate is 0.

18 18 18 18. With local taxes the. VT Taxable Income is 82000 Form IN-111 Line 7.

IN-111 Vermont Income Tax Return. 8 8 8 8. Local tax rates in Vermont range from 0 to 1 making the sales tax range in Vermont 6 to 7.

2021 Vermont Tax Tables. Enter 3189 on Form IN-111 Line 8. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from 0 to 1 across the state with an average local tax of 0153 for a total of 6153 when combined with the state sales tax.

W-4VT Employees Withholding Allowance Certificate. 0 0 0 0. The 2022 state personal income tax brackets are updated from the Vermont and Tax Foundation data.

State Income Tax Rates Highest Lowest 2021 Changes

Tennessee Sales Tax Small Business Guide Truic

How Is Tax Liability Calculated Common Tax Questions Answered

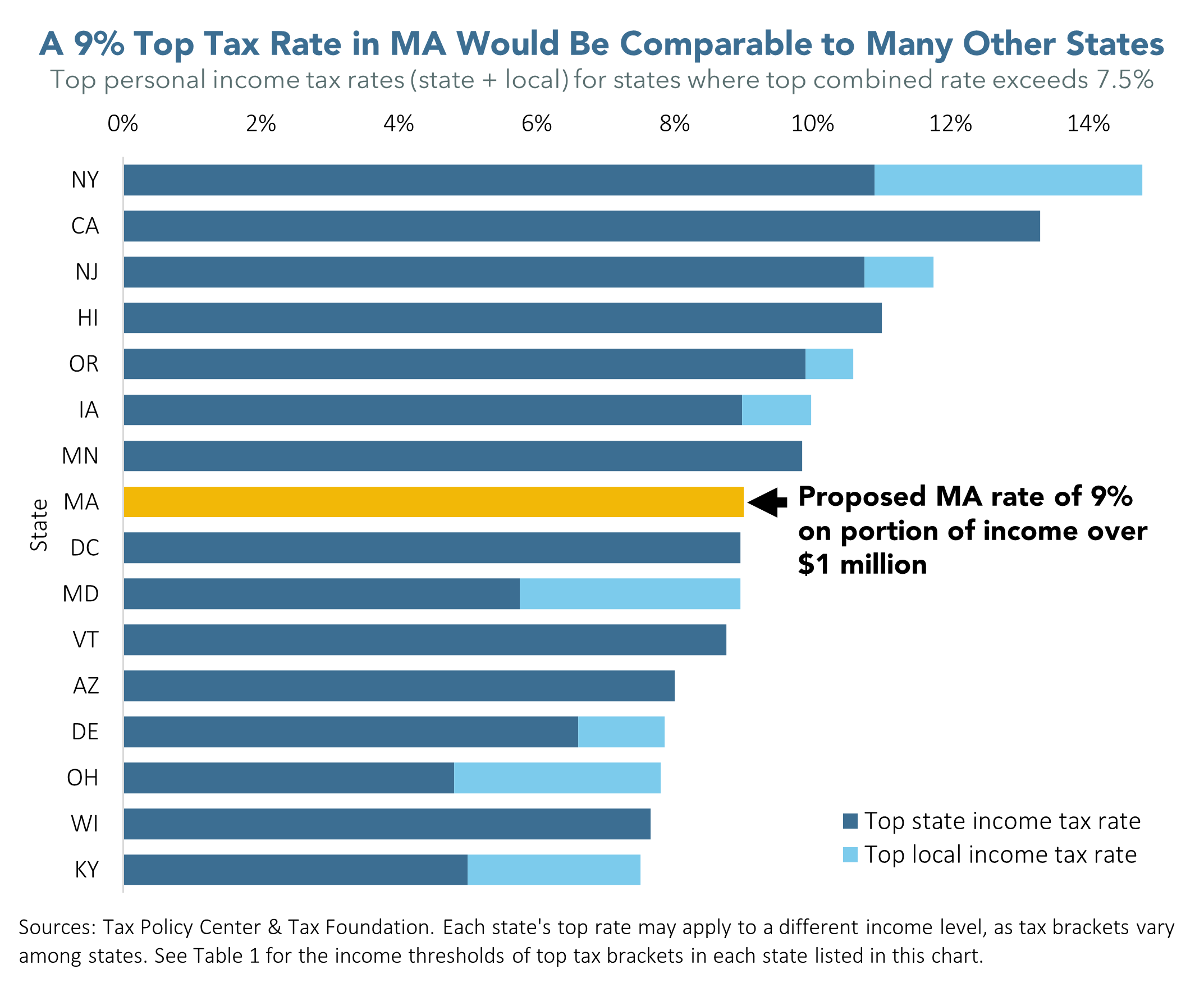

With Millionaire Tax Massachusetts Top Tax Rate Would Compare Well To Top Rates In Other States Mass Budget And Policy Center

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

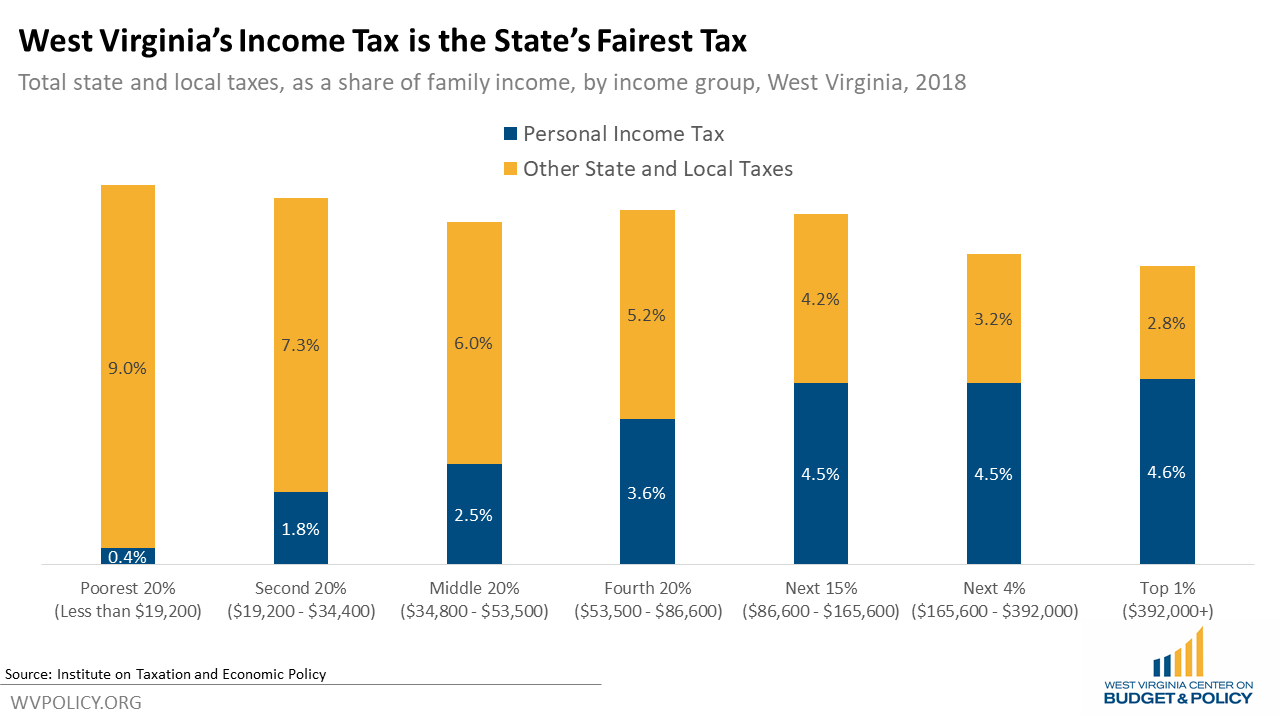

Eliminating The Income Tax Benefits The Wealthy While Undermining Important Public Investments West Virginia Center On Budget Policy

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

Washington Sales Tax Rates By City County 2022

States Without Sales Tax Article

How To Register For A Sales Tax Permit Taxjar

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom